dependent care fsa eligible expenses

The Only One-Stop-Shop Stocked Exclusively With FSA-Eligible Products. This Dependent Care FSA is intended to qualify as a Dependent Care Assistance Program under 129 of the Internal Revenue Code.

Benefits Guidebook January 1 December 31 2020 By Wfu Talent Issuu

Posted 2021-07-12 July 12 2021.

. The 2021 dependent-care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for. Learn more about how much you can save what it covers and how. Dependent Care FSA for Parents.

Expenses for non-disabled children 13 and older. Learn more about the benefits of a dependent care FSA with PayFlex. Dependent Care FSA Eligible Expenses.

A spouse who is physically or mentally unable to care for himherself. A date night babysitter may not qualify as an. Ad Shop The Largest Selection Of FSA-Eligible Products Today And Get Free Shipping 50.

Daycare nursery school and preschool. Qualified dependent care expenses. His employer pays directly to his dependent care provider an additional 1000 under a qualified dependent care benefit plan.

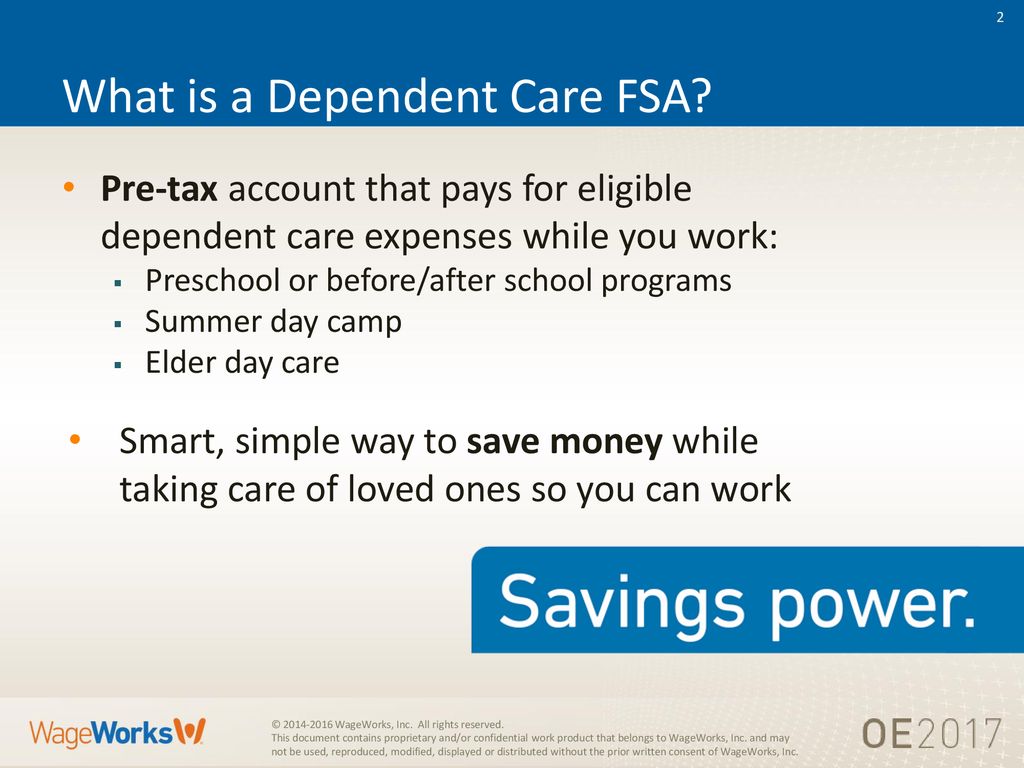

What is a dependent care FSA. The cost of routine skin care face creams etc does not qualify. Dont pay full price get the tax-advantaged rate.

Estimate your expenses carefully. He pays work-related expenses of 7900 for the care of his 4-year-old child and qualifies to claim the credit for child and dependent care expenses. By Hayden Goethe A dependent care flexible spending account lets participants set aside pre-tax dollars to help pay for dependent care.

Dependent Care FSA Eligible Expenses. George is a widower with one child and earns 60000 a year. To qualify as an eligible expense the babysitters services must allow you to be able to work or look for work.

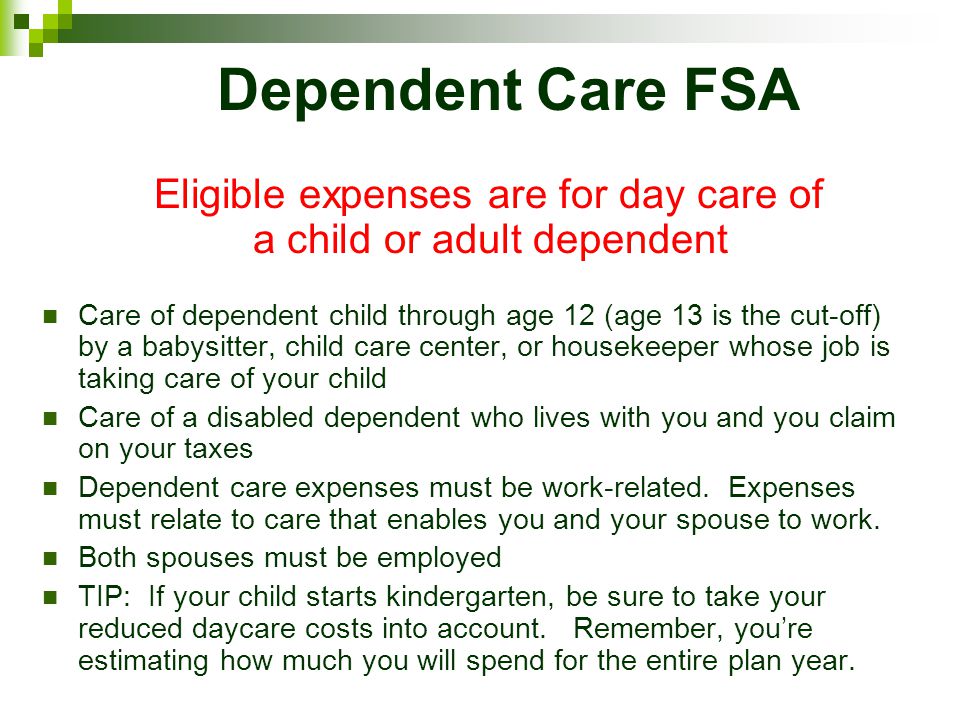

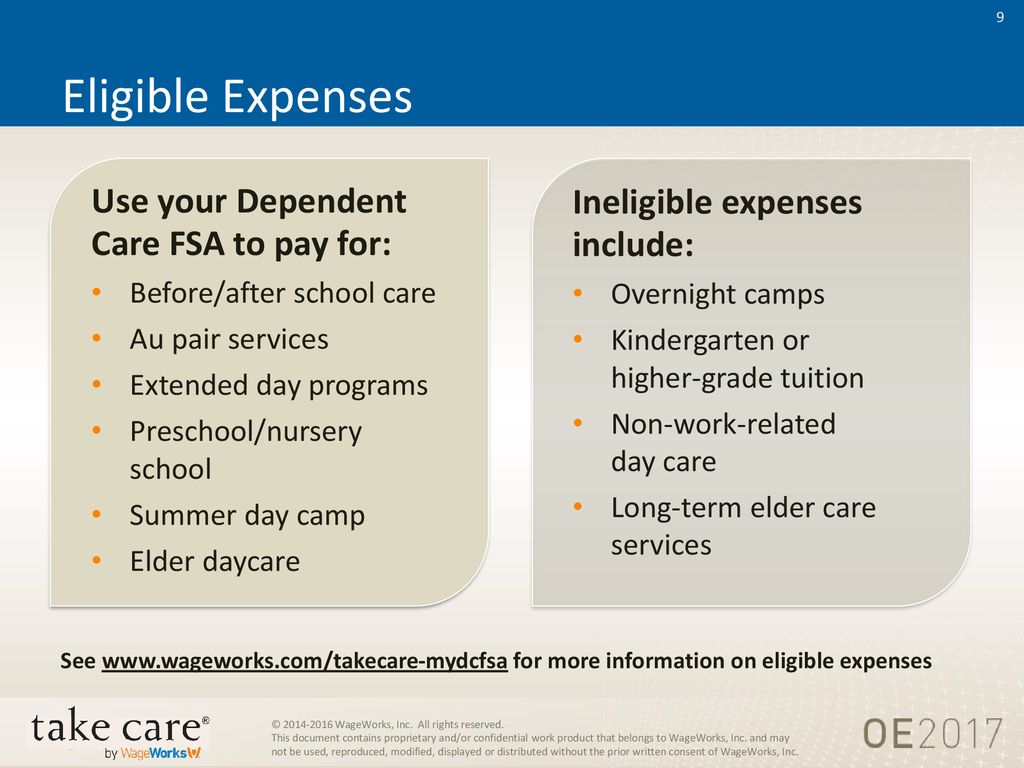

This document can be used to help you determine which expenses may be eligible for reimbursement under your Health Care or Dependent Care Flexible Spending Account FSA. Incurred during the period of. A dependent care flexible spending account covers qualified day care expenses for children younger than age 13 and adult dependents who are incapable of caring for themselves.

Medical FSA HRA HSA. The IRS has outlined the following items as not being eligible for tax-free purposes using Dependent Care FSA funds including. You may only use the funds that are available in your.

Babysitting and nanny expenses. The Internal Revenue Service IRS decides which expenses can be paid. As soon as your account is funded you can use your balance to pay for many eligible dependent care expenses.

While this list identifies the eligibility of some of the most common dependent care expenses its not meant to be comprehensive. A dependent care flexible spending account covers qualified day care expenses for children younger than age 13 and adult dependents who are incapable of caring for themselves. A Dependent Care FSA is an Internal Revenue Code IRC 129 account that allows a participant to set aside up to a defined plan limit see our Plan Limits page per calendar year on a pre-tax basis to pay for qualified dependent care expenses.

Allow employees to establish revoke or modify health or dependent care FSA contributions mid-plan year on a prospective basis during calendar year 2020 and 2. The following lists are not all-inclusive. Ad Download fax print or fill online FSA004 more Subscribe Now.

A family using an FSA to cover qualifying expenses can save thousands of dollars every year with little downside. You may incur qualified expenses through the end of the Dependent Care FSA Grace Period ending March 15 2023. What expenses are covered.

However unless the administrator has reason to believe that an expense does not qualify for reimbursement there will be no further inquiry made by the administrator. Dependent Care FSA. While this list shows the eligibility of some of the most common dependent care expenses its not meant to be comprehensive.

You can use your Dependent Care FSA DCFSA to pay for a wide variety of child and adult care services. Unfortunately not all dependent care FSA expenses are covered. A Dependent Care FSA can cover expenses paid to a babysitter under the age of 19 as long as they are not your or your spouses child stepchild foster child or tax dependent.

Allow unused funds remaining in a health or dependent care FSA at the end of a grace period or plan year ending in 2020 to be used to pay or reimburse expenses incurred. To be considered qualified dependents must meet the following criteria. Children under the age of 13.

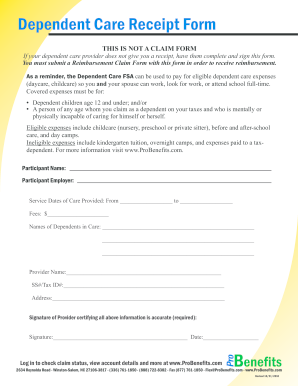

16 rows Various Eligible Expenses. The IRS determines which expenses can be reimbursed by an FSA. The dependent care FSAs third-party administrator will require the employee to certify that the expenses are eligible for reimbursement upon submitting a claim.

If youre enrolled in a dependent care flexible spending account DCFSA you can use your pre-tax funds to cover expenses for your childdependent under the age of 13 as well as adult dependents based on dependents you claim on your tax returns for dependent care while you or your spouse work or. What Is a Dependent Care FSA. Educational expenses including kindergarten or private school tuition fees.

This list is not meant to be all-inclusive. For a complete list of qualified dependent care expenses see IRS Publication 503. Cover expenses for your childdependent.

The IRS determines which expenses are eligible for reimbursement. You can use your Dependent Care FSA to pay for a huge variety of child and elder care services. Your family is completely taken care of while youre busy on the job.

A dependent care flexible spending account DCFSA is an employer-provided tax-advantaged account for certain dependent care expenses. Using a flexible spending account FSA is a great way to pay for eligible expenses with income tax-free dollars. When the expense has both medical and cosmetic purposes eg Retin-A which can be used to treat both acne and wrinkles a note from a medical practitioner recommending the item to treat a specific medical condition is required.

Care for your child who is under age 13 Before and after school care. Common FSA eligibleineligible expenses. Qualified dependent care expenses must meet the following criteria.

Contributing to this benefit reduces taxable income and spreads the benefits of pre-tax dollars throughout the year helping you save 30 percent or more on your. Further the reimbursements of Qualifying Employment-Related Expenses under this Dependent Care FSA are intended to be eligible for exclusion from Participants gross income under 129 and 125. As required by the IRS any funds remaining in your account after all claims submitted by the March 31 2023 submission deadline run-out period are forfeited.

Its goal is to help cover the costs of providing professional care so that the caregiver can work look for work or attend school full-time. Dependent care FSA-eligible expenses include. In order to take a distribution from the dependent care FSA for a parents dependent care expenses the parent must be a tax dependent under IRC 152 as modified by 21 b 1 B who is a physically or mentally incapable of caring for himself or herself and b has the same principal place of abode as.

September 16 2021 by Kevin Haney. Like other FSAs the dependent care Flexible Spending Account allows you to fund an account with pretax dollars but this account is for eligible child and adult care expenses including preschool nursery school day care before and after school care and summer day camp. The following lists are not all-inclusive but will highlight some common eligible expenses for your health care FSA limited purpose FSA or dependent care FSA.

Any adult you can claim as a dependent on your tax return that is physically or mentally unable to care for himherself. The Internal Revenue Service IRS decides which expenses can be paid. The IRS limits the total amount of money you can contribute to a dependent-care FSA.

A dependent care FSA DCFSA provides tax savings for the care of your children a disabled spouse or legally dependent parent during your working hours. It pays to learn the Dependent Care Flexible Spending Account FSA rules if you have a spouse not working or your child participates in programs that test the boundaries of IRS eligibility.

Dependent Care Flexible Spending Accounts Flex Made Easy

How A Dependent Care Flexible Spending Account Can Help Your Family Austin Benefits Group

File A Dca Claim American Fidelity

Dependent Care Open Enrollment 24hourflex

Flexible Spending Accounts Fsa 2020

What Is A Dependent Care Fsa Wex Inc

Using Your Dependent Care Fsa To Pay For Daycare Quality For Kids

How To File A Dependent Care Fsa Claim 24hourflex

Why You Should Consider A Dependent Care Fsa

Dependent Care Fsa Flexible Spending Account Ppt Download

Flexible Spending Accounts Ppt Video Online Download

Dependent Care Fsa Babysitter Receipt Fill Online Printable Fillable Blank Pdffiller

Health Care And Dependent Care Fsas Infographic Optum Financial

Dependent Care Fsa Flexible Spending Account Ppt Download