us germany tax treaty withholding rates

151 rows Description of Withholding tax WHT rates. In fact under a 2006 amendment to the US-Germany income tax treaty the governments of both countries are allowed to share tax information with one another.

United States Netherlands Income Tax Treaty Sf Tax Counsel

Double Tax Treaties and Withholding Tax Rates.

. Like many countries Germany imposes a withholding tax on dividends paid to foreign investors. If a tax treaty between the United States and the foreign individuals payees country of residence provides an exemption from or a reduced rate of withholding. Send Us A Message Wired Glass Break Detectors Chilean tax system Santandertradecom.

The complete texts of the following tax treaty documents are available in Adobe PDF format. Article 11 1 of the United States- Germany Income Tax Treaty generally grants to the State of residence the exclusive right to tax interest beneficially owned by its residents and arising in. The double taxation treaty or the income tax agreement between Germany and the United States of America entered into force in 1990.

Verpassen Sie nicht diese einmaIige GeIegenheit. All groups and messages. 62 rows Corporate - Withholding taxes.

This table lists the income tax and. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. Last reviewed - 01 August 2022.

The Federal Republic of Germany will reduce its withholding rate on dividends paid to United States portfolio investors on a non-reciprocal basis from 15 percent to 10 percent. On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the. Todays issues Insights Industries Services About us Careers.

In the absence of a tax treaty this tax is imposed at a rate of 25. The purpose of the Germany-USA double taxation treaty. Most income tax treaties contain what is known as a saving clause which prevents a citizen or resident of the United States from using the provisions of a tax treaty in.

Skip to content Skip to footer. The United States has entered into various bilateral income tax treaties in. If you have problems opening the pdf document or viewing.

Convention between the United States of. Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount. Germany - Tax Treaty Documents.

This simplified procedure is only applicable to licensors who 1 are tax resident in a treaty state ie a state with which Germany has concluded an income tax treaty. Germany is a member of the European Union EU the United Nations UN NATA the G G20 and OECD. Ad Experte sagt sie ist die disruptivste Aktie der Welt.

The Federal Republic of Germany will reduce its withholding rate on dividends paid to United States portfolio investors on a non-reciprocal basis from 15 percent to 10 percent. You claim a reduced rate of withholding tax under a treaty on interest dividends rent royalties or other fixed or determinable annual or periodic income ordinarily subject to the. 98 rows Detailed description of corporate withholding taxes in Germany Notes.

Form W 8ben Definition Purpose And Instructions Tipalti

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

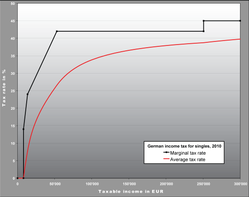

Income Tax In Germany For Expat Employees Expatica

What Is The U S Germany Income Tax Treaty Becker International Law

German Ip Withholding Tax White Case Llp

Refund Of German Withholding Taxes Good News For Foreign Investors Corporate Tax Germany

Double Taxation Of Corporate Income In The United States And The Oecd

Use Base Model Vectigal Corporation

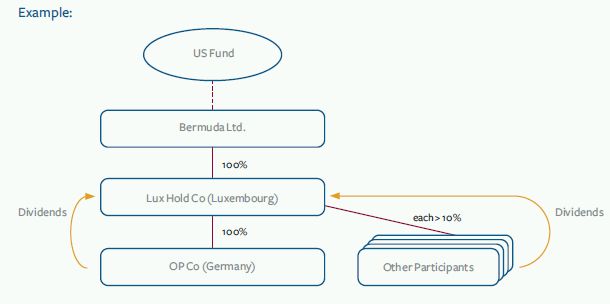

Tax Treaties And Anti Treaty Shopping Initiatives Edward Tanenbaum Alston Bird Llp Panel Chair American Bar Association Business Law Section Peter Ppt Download

Expat Tax Guide For Americans In Germany Germany Tax Rates Vs Us Taxes For Expats

Your Bullsh T Free Guide To Taxes In Germany

Panama Tax Treaties Withholding Tax Panama

Germany Country Profile 2019 Kpmg Global

Withholding Tax Relief Ppt Download

Your Bullsh T Free Guide To Taxes In Germany

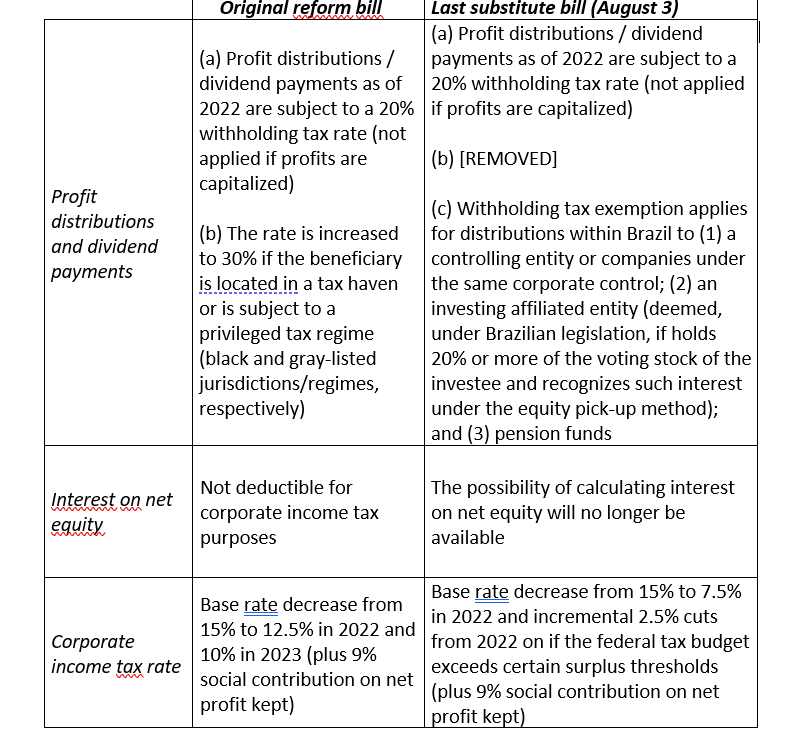

Brazil S Upcoming Tax Reform Will Impact Inbound Investors Mne Tax